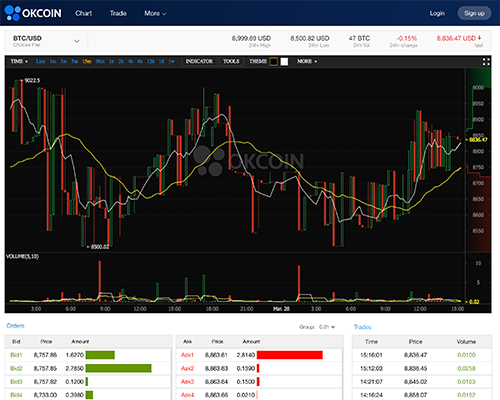

OKCoin is another top Bitcoin exchange. Even though it is based in China - it has offshoot offices around the world. With some of the largest volumes and good liquidity - best pricing is easy to achieve. OkCoin offers both LTC and BTC trading pairs into USD as well as futures on LTC and BTC with leverage up to 20 X.

Bringing a futures angle into the market makes OkCoin one of the more innovative exchanges out there and gives a breadth of options to structure various financial positions in both Bitcoin and Litecoin markets.

6.7

Margin tradingNo (Exchange does not support margin trading)

Margin tradingNo (Exchange does not support margin trading) Trust scoreA

Trust scoreA Beginner friendlyNo (Exchange is complex and difficult for beginners)

Beginner friendlyNo (Exchange is complex and difficult for beginners) Stability4. Very (Exchange is very stable)

Stability4. Very (Exchange is very stable) FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.)

FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.) APIYes (API is available for public to use)

APIYes (API is available for public to use) Rest APIYes (The Exchange has Rest API support)

Rest APIYes (The Exchange has Rest API support) WebsocketYes (The Exchange has Websocket support)

WebsocketYes (The Exchange has Websocket support) Mobile appNo (Exchange does not have a mobile app)

Mobile appNo (Exchange does not have a mobile app) Credit cardNo (Exchange does not support credit cards)

Credit cardNo (Exchange does not support credit cards) ReferralNo (Exchange does not offer an affiliate program)

ReferralNo (Exchange does not offer an affiliate program) LendingNo (Exchange does not support lending)

LendingNo (Exchange does not support lending) Stop limitNo (Exchange does not support stop limit)

Stop limitNo (Exchange does not support stop limit) US licenceNo (Exchange don't have US licence for Money transmitter)

US licenceNo (Exchange don't have US licence for Money transmitter) PGP supportNo (Exchange does not have PGP encryption)

PGP supportNo (Exchange does not have PGP encryption)The layout and functionality of the exchange is easy to understand and offers good security through its bespoke cold wallet technology to secure private keys offline with little to no risk.

Trading fees vary depending on your 30 day volume from 0.20% to 0.1% if your trading over 25,000 BTC. USD deposit fees range depending on the provider you use with OKpay at 1.5% and PerfectMoney at 3% - standard bank telegraphic transfers are only subject to the bank charges. The USD withdrawal fee is 0.1% or USD 15 - whichever is greater. For BTC and LTC withdrawals the exchange charges 0% - although the bitcoin and litecoin minimum network fee might apply.

At the beginning of 2017, the People's Bank of China announced inspections on the three major exchanges in the country. Following these inspections, OKcoin has halted margin trading services and instituted a trading fee of 0.2%/0.2%

Manuals for OkCoin

Trading instruments (cryptocurrencies)

There are a few altcoins available at OKCoin, but this is definitely not an exchange which list a lot of coins. The options currently available are: BTC, LTC, ETH, ETC and BCC. The addition of Etherem Classic and Bitcoin Cash will be appreciated by some users. Trading at OKCoin is only done against the Chineese Yuan (CNY), while the other brand owned by the company provides more products.

Minimum initial deposit

There is no information on the minimum deposit at OKCoin. This is rather odd, especially given the fact they accept deposits in Yuan. We are used to forex brokers, disclosing their entry barriers. For instance FXCM only requires a $50 deposit, for the opening of a new trading account.

Leverage

Margin trading is not available at OKCoin, while it is at the company’s other brand OKEX. In essence OKCoin is the company which takes fiat currency deposits (only in Yuan), while the other website is the more trader-oriented exchange. Leverage at crypto-exchanges is usually lower than the one provided for forex trading, where brokers often allow 1:500 or even higher ratios. That being said, cryptocurrencies are a lot more volatile, so margin trading is a lot riskier, in general.

Fees

Fees at OKCoin are competitive with the current offers by other brokers, going as high as 0.20%. With greater volumes, the rate declines, which is also a procedure applied by multiple exchanges. Luckily for the more aggressive traders there is no difference for market “makers” and “takers”. The forex brokers who offer bitcoin trading on the other hand include all of their costs in the spread. They also mostly provide CFD trading.

Review of OkCoin

OKCoin is the largest Chinese cryptocurrency exchange, which is mainly oriented towards the domestic market. The company targets retail customers, while also providing another brand OKEX, for the more sophisticated traders. Trading volumes and liquidity for the major coins are quite high.