Bitfinex is one of the oldest cryptocurrency exchanges on the market, founded in 2012 in Hong Kong. It offers various products such as spot and margin trading, derivates, paper trading, lending, staking, and more. Bitfinex is known for its low trading fees, fees are between 0 to 0.3% in popular cryptocurrencies.

The exchange is also the founder of well known USDT (Tether) which should cover the value of the U.S. Dollar. However, the exchange had issues with regulators due to USDT and was fined multiple times for misleading clients and the market manipulation by overstating Tether reserves and hiding losses, so that’s why the backing of the USDT was shady in the past. Bitfinex is recommended for advanced users due to the platform’s complexity, keep in mind there is also a minimum deposit of 10 000 USD, which can be hard to achieve for new users.

The exchange was subject to a hack in 2015, where hackers stole 1500 Bitcoins and one year later they stole 119756 Bitcoins, after the incident price of Bitcoin immediately dropped about 20%.

9.4

iOS: 8.4

Android: 8.4

Margin tradingYes (Exchange support margin trading)

Margin tradingYes (Exchange support margin trading) Trust scoreA

Trust scoreA Beginner friendlyNo (Exchange is complex and difficult for beginners)

Beginner friendlyNo (Exchange is complex and difficult for beginners) Stability4. Very (Exchange is very stable)

Stability4. Very (Exchange is very stable) FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.)

FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.) Support speedWeek (Technical support responds during the week)

Support speedWeek (Technical support responds during the week) SafetyA (Very secure)

SafetyA (Very secure) APIYes (API is available for public to use)

APIYes (API is available for public to use) Rest APIYes (The Exchange has Rest API support)

Rest APIYes (The Exchange has Rest API support) WebsocketYes (The Exchange has Websocket support)

WebsocketYes (The Exchange has Websocket support) Mobile appYes (Exchange has a mobile app)

Mobile appYes (Exchange has a mobile app) Credit cardNo (Exchange does not support credit cards)

Credit cardNo (Exchange does not support credit cards) ReferralNo (Exchange does not offer an affiliate program)

ReferralNo (Exchange does not offer an affiliate program) Two factor authentificationYes (The Exchange supports two factor authentication)

Two factor authentificationYes (The Exchange supports two factor authentication) LendingYes (Exchange support lending)

LendingYes (Exchange support lending) Stop limitYes (Exchange supports stop limit)

Stop limitYes (Exchange supports stop limit)ADVANTAGES OF BITFINEX

- Low fees

- Various number of crypto services

- Advanced platform

DISADVANTAGES OF BTFINEX

- Shady past

- Unavailble trading without registration

- Minimum deposit 10 000 USD

Bitfinex is a Hong Kong based trading platform that was founded in 2012 by Raphael Nicolle. The exchange is both owned and operated by iFinex, Inc. and has managed to work its way to the top of the charts in terms of trading volumes and user activity on the platform. Bitfinex is one of the largest cryptocurrency trading platforms, and is generally popular with traders across the globe, however, the team behind the exchange recently decided to discontinue providing their services to U.S. customers and focus on their users based in other parts of the world.

The exchange currently handles approximately $2B worth of trades a day, and records 24 hour trading volumes worth around $600m for its BTC/USD pairing, and this represents around 6.27% of the total market. These high trading volumes are a result of the team behind the exchange focusing on providing a high level of service for traders by utilizing a wide coin selection, low fees, and a comprehensive interface. The exchange also allows fiat deposits and houses a variety of cryptocurrencies with approximately 72 market pairs active on the platform. Bitfinex also attracts institutional investors and operates an OTC desk for high value over the counter trades. Despite its success, Bitfinex has also attracted a fair amount of controversy as a result of suffering a number of hacks, and being closely linked to the Tether stablecoin.

Manuals for Bitfinex

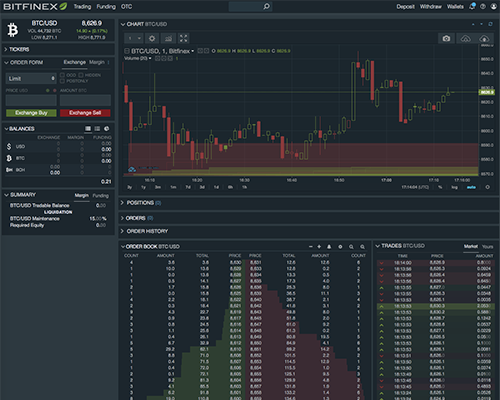

In the Order Form section, you can create new trades (open a new order) here.

Exchange trading refers to spot trading, where an actual transaction of BTC and USD take place and the asset in question changes hands. You can buy BTC with your USD, or you can sell your BTC into USD.

Margin trading is where you don't have to actually own BTC to sell BTC, or own USD to buy BTC. With margin trading, you can go 'long' or 'short' on any market by using your leveraged funds.

Order Types

Whether you're trading on Bitfinex's spot exchange or margin platform, the types of orders you can open remain the same. There are 7 types of orders available, namely:

- Limit Order

- Market Order

- Stop Order

- Stop Limit Order

- Trailing Stop Order

- Fill or Kill Order

- Advanced Orders

Security rating of Bitfinex

As one of the older exchanges in operation today, Bitfinex has experienced a number of hacks with the first major hack taking place in May, 2015. On this occasion a hacker was able to obtain 1500 Bitcoin from a hot wallet controlled by the exchange, the lost funds were quickly reimbursed by the exchange. However, a later attack proved to be more problematic as a hacker was able to circumvent security on the platform and access up to 119,756 Bitcoin, which were worth an approximate $72m at the time.

The hacker was able exploit a vulnerability in the multi signature system Bitfinex employed alongside Bitcoin wallet provider Bitgo and in response to the theft, the exchange chose to issue BFX tokens which were to be redeemed by its customers at a later date. Each BFX token was worth $1 and was awarded in the same amount lost by each investor. Since issuing the tokens, Bitfinex has purchased them all back and completed their purchases in April, 2017.

As a result of these hacks, Bitfinex has stepped up its security and currently, 99.5% of client funds are stored offline in a cold storage system that employs a multisignature function that is geographically distributed across multiple secure locations.

Client accounts are secured by using 2FA and U2F, in addition to PGP email encryption. Accounts are also monitored and strengthened by using a number of advanced verification tools that cover account activity. These include:

- The analysis of saved login data to root out unusual activity.

- The use of an intelligent system that detects IP address changes and prevents session hijacking.

- Email notifications that report logins and include a link to instantly freeze your account if you suspect malicious activity.

- Limiting access to your account based on IP address.

Bitfinex also chooses to closely monitor withdrawals in order to help stave off attacks; the platform’s security system currently monitors withdrawals by IP address and other behavioural patterns that trigger manual inspection on withdrawals that appear to be unusual. Customers can also whitelist an address to ensure that withdrawals can only be sent to that particular location. Bitfinex also claims that it uses a withdrawal confirmation step that is immune to malicious browser malware.

Review of Bitfinex

Bitfinex is one of the most established exchanges in operation today and provides a service tailored to experienced traders and institutional investors. As a result of this, the exchange enjoys high USD liquidity, while offering extensive orders and trading options, and is the largest BTC exchange by volumes traded.

However, Bitfinex has courted controversy on a number of occasions and isn’t a very transparent company, after learning of its history some potential users may be put off by any security concerns they might have even though the exchange paid back all the losses from its 2016 hack. The team behind Bitfinex also need to clear up the relationship they have with Tether in order to ease the current customer concerns regarding the situation.

With this in mind, we would recommend that anyone using Bitfinex to only keep a small balance on the exchange at any time, making sure to withdraw your currencies to your own wallet and make sure to use all the security features available to you on the site