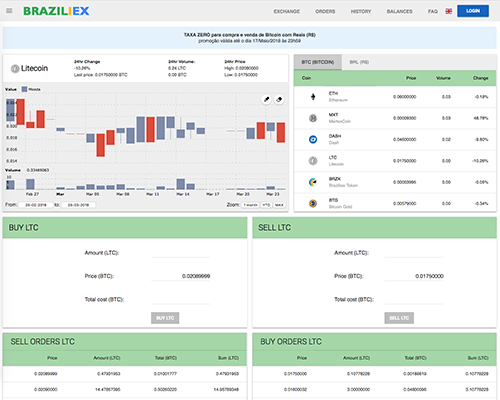

As its name suggests, Braziliex is a Brazilian exchange that allows users to trade between a number of different virtual currencies, as well as Brazilian Real (BRL).

Like most similar venues, Braziliex utilizes two-factor authentication (2FA) in order to reduce fraud risks. Depending on user verification, the exchange has set several daily withdrawal limits:

5.2

Margin tradingNo (Exchange does not support margin trading)

Margin tradingNo (Exchange does not support margin trading) Trust scoreB

Trust scoreB Beginner friendlyNo (Exchange is complex and difficult for beginners)

Beginner friendlyNo (Exchange is complex and difficult for beginners) Stability3. Much (Exchange is stable, but it has a downtime in the high stakes)

Stability3. Much (Exchange is stable, but it has a downtime in the high stakes) FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.)

FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.) APIYes (API is available for public to use)

APIYes (API is available for public to use) Rest APIYes (The Exchange has Rest API support)

Rest APIYes (The Exchange has Rest API support) WebsocketNo (The Exchange does not have Websocket)

WebsocketNo (The Exchange does not have Websocket) Mobile appNo (Exchange does not have a mobile app)

Mobile appNo (Exchange does not have a mobile app) Credit cardNo (Exchange does not support credit cards)

Credit cardNo (Exchange does not support credit cards) ReferralNo (Exchange does not offer an affiliate program)

ReferralNo (Exchange does not offer an affiliate program) Two factor authentificationYes (The Exchange supports two factor authentication)

Two factor authentificationYes (The Exchange supports two factor authentication) LendingNo (Exchange does not support lending)

LendingNo (Exchange does not support lending) Stop limitNo (Exchange does not support stop limit)

Stop limitNo (Exchange does not support stop limit) US licenceNo (Exchange don't have US licence for Money transmitter)

US licenceNo (Exchange don't have US licence for Money transmitter) PGP supportNo (Exchange does not have PGP encryption)

PGP supportNo (Exchange does not have PGP encryption)Braziliex Advantages

Decent amount of altcoins available

By the time of writing the present review, Braziliex offers 8 altcoins for trade, including the popular ETH, LTC, BCH, BTG, and XMR.

Trading against BRL

The most obvious advantage of this exchange is the fact that it offers trading against the local currency (BRL). The most popular trading pairs at Braziliex are BTC/BRL, ETH/BRL, and LTC/BRL

Brazilian bank transfers supported

being able to deposit and withdraw in their local currency via bank transfer is without a doubt a significant convenience to Brazilian traders. When it comes to withdrawal fees, however, they are solid, and some Braziliex clients complain about the slow process.

Some exchanges accept credit cards and while the fees involved may also be pretty salty, at least you get instant execution.

Relatively good platform

Braziliex’ web-based platform offers the basic functionalities that a crypto investor needs, such as an order book, some simple charting, order cancellation option and trading history window. The instruments are grouped into two categories: currencies traded against Bitcoin, and such traded against Brazilian Real.

Braziliex Disadvantages

High trading fees

All trades on Braziliex incur a fee of 0.50%, which is at least double the size of what most exchanges charge (and many of them charge only market “takers”). On top of that, Braziliex also applies withdrawal fees. For example, bank wire withdrawals in BRL are charged R$ 9.00 + 0.25%, while those in Bitcoin – with 0.0010 BTC.

Low liquidity

We have noticed that the trading volumes of some pairs on Braziliex platform appear low and some clients also complain of low liquidity.

No margin trading

As we mostly review forex brokerages, we are used to them offering margin trading, however most typical crypto-exchanges don`t provide such a service. Braziliex is no exception. If you need some leverage, you can check out exchanges like Kraken or bitFlyer,. Forex brokers that offer trading in Bitcoin may also present a decent alternative.

Not regulated

Although this is not something out of the ordinary in the crypto-verse, and Braziliex seems like a legitimate exchange, we have to mention that the company that owns and operates it is not regulated in Brazil, nor anywhere else. You should keep in mind that in the case of Braziliex and most exchanges that are not decentralized, a counter-party risk always exists.

No information about storage of clients’ funds

We could not find any information about the protection levels of client funds onBraziliex website. It is unclear whether the company keeps them in cold storage,like most exchanges do for security reasons.

Review of Braziliex

To sum things up, Braziliex is an exchange made by Brazilians for Brazilians: its clients are able to trade various digital currencies against their local currency (BRL), as well as to make wire transfers from and to Brazilian banks. Coin-to-coin trading is also enabled.

If you are not living in Brazil, however, this exchange will not be of much of abenefit to you, as its trading fees are comparatively high, while trading volumes on non-BRL pairs are rather poor. As we went through some community opinions shared on popular Bitcoin forums, we get the impression that many local investors prefer FoxBit (although it offers only trading in BTC/BRL) or major global exchanges like and Bitstamp or Coinbase, which offer banking services to a wide range of countries.

Braziliex is owned and operated by Braziliex Moedas Virtuais Ltda ME, a company that is not regulated, as is the case with most crypto-exchanges around the world. We remind you that you can also trade in cryptocurrency CFDs with forex brokers, just be sure to understand the differences.