Bitlish is a bitcoin company first launched in April 2015, then introduced on the Bitcointalk forums on December 1, 2015.

Bitlish makes many of the same promises as other bitcoin exchange platforms. You can enjoy safe, easy Bitlish trading from your account. Bitlish also offers cards and ATMs. There’s a 0% maker/0.2% taker fee structure.

As of November 2017, Bitlish is sitting at the #116 spot in the list of the top cryptocurrency exchanges by 24 hour trading volume, according to CoinMarketCap. The most popular pairs including BTC/USD, BTC/EUR, BTC/RUB, and ETH/USD, which account for about 95% of trading volume on the marketplace.

6.7

Margin tradingNo (Exchange does not support margin trading)

Margin tradingNo (Exchange does not support margin trading) Trust scoreB

Trust scoreB Beginner friendlyNo (Exchange is complex and difficult for beginners)

Beginner friendlyNo (Exchange is complex and difficult for beginners) Stability3. Much (Exchange is stable, but it has a downtime in the high stakes)

Stability3. Much (Exchange is stable, but it has a downtime in the high stakes) FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.)

FiatYes (The Exchange supports Fiat currency as USD, EUR, etc.) APIYes (API is available for public to use)

APIYes (API is available for public to use) Rest APIYes (The Exchange has Rest API support)

Rest APIYes (The Exchange has Rest API support) WebsocketYes (The Exchange has Websocket support)

WebsocketYes (The Exchange has Websocket support) Mobile appYes (Exchange has a mobile app)

Mobile appYes (Exchange has a mobile app) Credit cardYes (Credit card support)

Credit cardYes (Credit card support) ReferralNo (Exchange does not offer an affiliate program)

ReferralNo (Exchange does not offer an affiliate program) Two factor authentificationYes (The Exchange supports two factor authentication)

Two factor authentificationYes (The Exchange supports two factor authentication) LendingNo (Exchange does not support lending)

LendingNo (Exchange does not support lending) Stop limitNo (Exchange does not support stop limit)

Stop limitNo (Exchange does not support stop limit) US licenceNo (Exchange don't have US licence for Money transmitter)

US licenceNo (Exchange don't have US licence for Money transmitter) PGP supportNo (Exchange does not have PGP encryption)

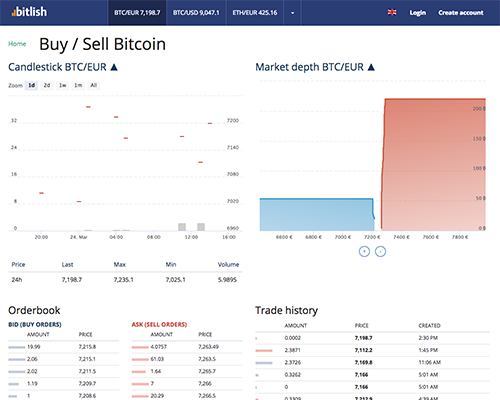

PGP supportNo (Exchange does not have PGP encryption)Bitlish works a little differently from other bitcoin exchanges. You don’t actually trade bitcoins for other cryptocurrencies. Instead, this is just a bitcoin exchange platform where you can match your bitcoin or fiat currencies with other orders on the platform.

To get started, you deposit your bitcoins or fiat currency (USD, EUR, or RUB) into your account. Then, you match to any of the orders on Bitlish or create your own order.

After the order is completed, you withdraw bitcoins from your account to your bitcoin wallet. If you’re selling bitcoin for fiat currency, then you can also withdraw fiat currency to your credit card or bank account.

Before using Bitlish, you’ll need to confirm your phone number and verify your account with AML/KYC requirements. You’ll need a scanned copy of your ID and a utility bill, for example. You should be verified within about 24 hours.

One of the unique things about Bitlish is that there’s no maker fee. You don’t get charged when you’re making offers on the platform (i.e. you post the offer yourself). However, there’s a taker fee of 0.2% (for verified users) or 0.3% (for anonymous users).

Your credit card deposits will also be charged 3.5%, then 2.5% on withdrawals. Bitlish seems to be open and transparent about its fee structure. You can view full details about Bitlish fees on their website.

Manuals for Bitlish

Trading instruments (cryptocurrencies)

Bitlish offer trading in the most popular digital coins and several fiat currencies (USD, EUR and RUB). At the moment of writing this review, these include Bitcoin, Ethereum, Litecoin, Zcash, Doge, Dash, Bitcoin Gold, Monero.

Currently, the most traded pairs are BTC/USD and BTC/EUR.

Minimum initial deposit

Unlike most cryptocurrency exchanges do not clearly specify a minimum deposit level, Bitlish requires suchfor both blockchain transfers, and those in fiat currencies. For example, Bitcoin payments must be no less than 0.00001 BTC, and Bank transfers should be of at least 5 EUR. Maximum payment limits are also set on a monthly basis.

Leverage

Obviously, Bitlish does not provide margin trading, as it mentions nothing on its website about leverage. Leverage or margin allows you to operate with large amounts of money, while actually having made rather small investments. This, however, involves greater risk of losses.

If you are willing to take that risk, some crypto-exchanges like Kraken and CEX.IO allow margin trading. Besides, you can also trade in digital coins with forex brokerages, all of which offer some leverage.

Fees

As we have mentioned above, Bitlish is quite open and transparent about its fee structure. In terms of trading, it charges market takers only. Verified users are charged 0.2%, and anonymous ones– 0.3% per trade. On the other hand, traders who place pending orders and provide liquidity to the exchange (market makers)are not subjected to any trading fees.

While these fees are competitive when compared to those applied by other plaers in the cryptosphere, we should note that many exchanges charge both market takers and market makers. For example, such is the case with major US crypto-exchange Poloniex.

Review of Bitlish

Bitlish a UK-based cryptocurrency exchange. The company accepts bank transfers and credit cards, supporting several fiat currencies, and offers trading in a decent amount of the major digital coins. Besides, the community feedback about the company is rather positive. While fees charged by Bitlish are transparent and competitive, we find its platform too basic.