Bibox is a relatively new Chinese cryptocurrency exchange, which is quickly gaining popularity. In its basic form, Bibox can be thought of as an “intelligent transaction platform” that is designed exclusively for blockchain based assets. In addition to this, Bibox also aims to serve as a knowledge tool that can help increase awareness regarding digital currencies and other alt-assets amongst novice investors.

7.4

Margin tradingYes (Exchange support margin trading)

Margin tradingYes (Exchange support margin trading) Trust scoreB

Trust scoreB Beginner friendlyNo (Exchange is complex and difficult for beginners)

Beginner friendlyNo (Exchange is complex and difficult for beginners) Stability4. Very (Exchange is very stable)

Stability4. Very (Exchange is very stable) FiatNo (The Exchange does not support Fiat currency like USD, EUR, etc ...)

FiatNo (The Exchange does not support Fiat currency like USD, EUR, etc ...) APINo (The Exchange does not have an API)

APINo (The Exchange does not have an API) Rest APINo (The Exchange does not have an API)

Rest APINo (The Exchange does not have an API) WebsocketNo (The Exchange does not have Websocket)

WebsocketNo (The Exchange does not have Websocket) Mobile appNo (Exchange does not have a mobile app)

Mobile appNo (Exchange does not have a mobile app) Credit cardNo (Exchange does not support credit cards)

Credit cardNo (Exchange does not support credit cards) ReferralNo (Exchange does not offer an affiliate program)

ReferralNo (Exchange does not offer an affiliate program) Two factor authentificationYes (The Exchange supports two factor authentication)

Two factor authentificationYes (The Exchange supports two factor authentication) LendingNo (Exchange does not support lending)

LendingNo (Exchange does not support lending) Stop limitNo (Exchange does not support stop limit)

Stop limitNo (Exchange does not support stop limit) US licenceNo (Exchange don't have US licence for Money transmitter)

US licenceNo (Exchange don't have US licence for Money transmitter) PGP supportNo (Exchange does not have PGP encryption)

PGP supportNo (Exchange does not have PGP encryption)Bibox Advantages

Experienced team – according to multiple sources, Bibox was founded by people who were previously involved with other exchanges, like OKCoin and Binance. This is a positive sign, despite the fact the company does not provide a presentation of their team (and the information is not confirmed).

2FA supported – this exchange supports the popular security, which allows you to verify logins with a mobile app. This way, even if someone knows your e-mail and password, they will need access to your smartphone in order to hack your account.

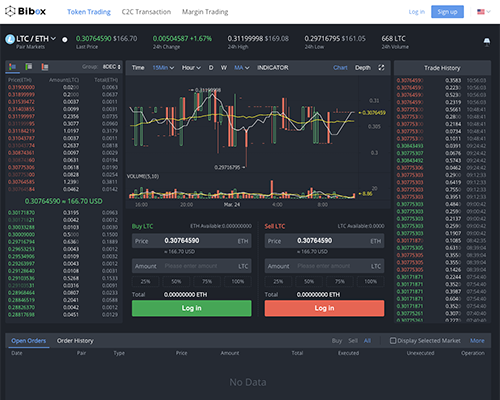

Solid platform – the trading interface provided by Bibox has two layouts. The simple one has a bit too much information put together in a small portion of “screen space”, but is still rather intuitive. In contrast, the full screen one places a lot of focus on the charts.

Very low fees – one of the biggest advantages of trading at Bibox is the fact it’s very cheap, when compared to other exchanges. With a market taker fee of 0.15% and no fees for makers, active traders should enjoy this venue. As a comparison, most established trading venues charge around 0.20-0.25%.

BIX Token – Bibox was created with an ICO, which gave investors a new token. It can be used at the exchange, to reduce the costs of trading even further. There are speculations for further benefits for BIX holders, but the information is a bit conflicting. In case you want to pay your fees with tokens, the discount will be as follows

Wide range of altcoins – the number of digital assets traded at Bibox is impressive – there are over 80 coins, with new ones being added constantly. They are traded against BTC, ETH, USDT and DAI. Some of the popular coins at this exchange include Litecoin, EOS, NEO and TRON, while one of the more interesting alternative ones is the High Performance Blockchain (HPB).

Bibox Disadvantages

Chinese exchange – while Bibox seems to be very open towards foreigners, unlike some other locally oriented exchanges, the risk of further regulation is still present. Rumors of China banning cryptocurrencies in one way or another reappear every few weeks. They may have lost credibility at this point, but there should be at least some basis behind them.

No direct fiat currency deposit methods – Bibox is definitely not an entry-level exchange, but has partnered with LinkCoin, which is. Still, those of you who are new to the space, may like to look at the companies which accept credit cards.

Two “Tether” coins supported – one can trade coins against USD Tether and DIA at Bibox. As some of you may know these are tokens which represent one dollar. There are serious reasons to believe the former doesn’t have enough cash to cover all the “minted” coins, which can lead to a serious problem in the future.

Not the expected priority of altcoins – while there are a lot of coins at this trading venue, they may not be the ones you would expect. This is even more obvious when you look at the volumes – Bibox seems to be a heaven for some rather unpopular altcoins.

No leveraged (yet) – this exchange is currently developing a margin trading system. The aggressive traders among you may be better suited with a forex broker.

Manuals for Bibox

Security rating of Bibox

One of the key aspects of Bibox is its use of a “microservice splitting” design which helps breakdown voluminous transactions into smaller bits. As a result of this, transactions can be carried out in a much more secure and efficient manner.

Review of Bibox

Bibox is a new Chinese cryptocurrency exchange, which is on the rise. They provide vcry low costs of trading, a decent platform and slightly unusual (albeit extensive) coin offering. Updates are constant, with new coins being added frequently.

In order to properly judge such a young project, one must look at the user review. While the English ones are relatively few, they are mostly positive, with complains being focused mostly on the speed of customer support.

Keep in mind, whenever you are dealing with a centralized cryptocurrency exchange they are the ones holding your coins. This leaves to the inherit risk of the company simply shutting down and running away with all the clients’ funds. This is not the case, with highly regulated forex brokers. Check the link below for more info.